Professional Insight

Choosing Multiples for Business Valuations

Topics discussed in this paper include:

SME Valuation Multiples Capitalisation Rates Industry Multiples

Most Business Valuers will agree, the question they are asked most often is: “what are the current valuation multiples by industry?” One reason is that Accountants, Business Valuers, Finance Professionals and Entrepreneurs most often use the Capitalisation of Earnings method when valuing a business. Whilst the method is widely understood, just how to settle upon the most appropriate and relevant multiple to apply remains a mystery to many. This paper aims to shed some light on the reasons why.

What are the current valuation multiples by industry?

Much to the dismay of many who ask this question, there is no standardised database of SME industry multiples.

From time to time articles and reports are published, attempting to establish a formularised approach to multiples. When put to the test the individual nature of each valuation makes standardised multiples difficult to apply. For such a database to be reliable for general application:

- the sample size would need to relatively significant;

- be based on actual (reported) sales;

- rely on multiples consistently applied across both industry sector and segment; and

- the uniquely complex aspects of all transactions over-simplified to enable comparisons on a like-for-like basis.

These basic fundamentals are very hard, if not impossible, to achieve.

Why is it so hard to build a reliable database of business valuation multiples? There are several reasons:

- Most SME business sales are conducted in private between companies or individuals with no requirement to disclose the details of the sale.

- Every business is very different, we have seen businesses within the same industry sell for vastly different valuation multiples. Without knowing the full details of each business, one would be foolish to compare the valuation multiples or take an average. For example, we have valued businesses within the manufacturing industry with multiples as low as 1x and as high as 7x. That is far too great a range to contemplate relying on or averaging without first knowing the intricacies of each business.

- Valuation multiples are often published with different parameters, for example a multiple of 3x Net Profit before Tax is very different to 3x Net Profit after Tax. Also, what exactly is being ‘multiplied’? Some valuations use an average, or weighted average of historical earnings, some use forecast earnings, some even use earnings before allowing for a market rate salary to the owners.

The inevitable conclusion remains: if you are lucky enough to source some actual valuation multiples, they can only be fully understood (and therefore relied upon) when considered in the full context of each of the business(es) involved.

So, how do you identify an appropriate multiple?

Having established that relying on comparable SME valuation multiples is inherently difficult, if not impossible, how does one determine an appropriate valuation multiple?

Essentially we need to determine the required rate of return on a business by considering its risk profile.

A rate of return (or capitalisation rate) can be converted to a multiple by dividing 1 by the capitalisation rate. For example, if it is determined that a required rate of return to invest in a business is 25%. Its multiple would be calculated as 1 divide 0.25 = 4.00.

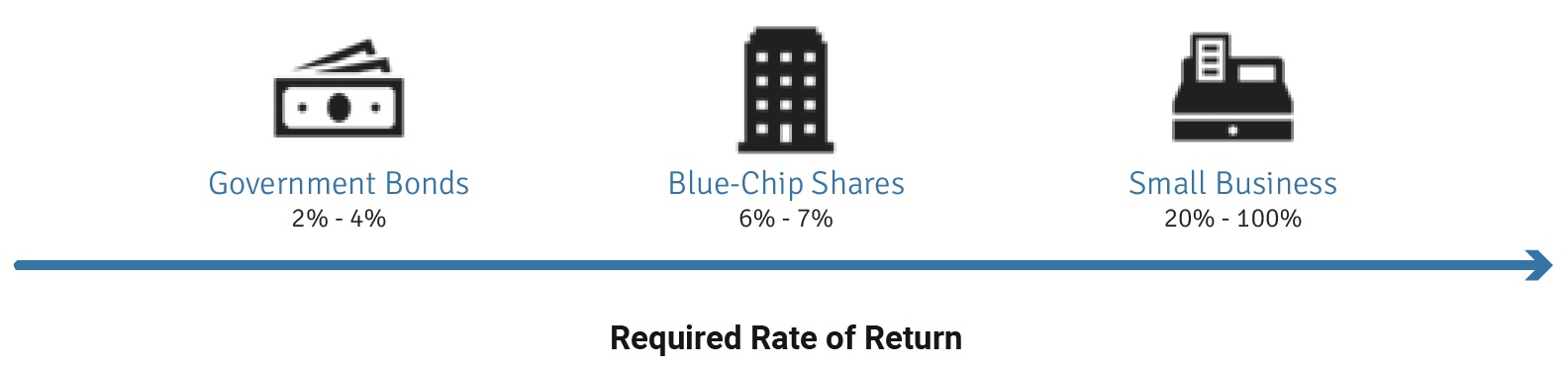

The higher level of risk a business has, the higher rate of return an investor would require to invest in the business. Conversely, a low risk asset or business would only need a small rate of return to attract investors. An example of this is Government Bonds. Australian Government Bonds may only offer a return of around 2% to 4% but because they are considered to be almost risk free, this is an acceptable rate of return.

A little further up the scale of risk are shares in ASX listed blue-chip companies. Shares in these large companies generally provide an average return of around 6% – 7% over the long term (equates to a multiple of 14x to 16x). This return is slightly higher than the government bonds, compensating for the small additional risk.

At the risky end of the scale we have small businesses. Valuation multiples of SME’s vary considerably across a common range of 1 to 5 times earnings. This equates to a capitalisation rate of 20% to 100%. This higher required rate of return is clearly due to the high risk profile of SME’s.

Having established a range of capitalisation rates as shown above, we then get down to the contentious task of determining the capitalisation rate on a per business level. This is where the independence and experience of a professional business valuer is required. While every business is different and every valuer might have a slightly different approach, essentially the risk profile of a business can be revealed by a considered assessment of the following intertwined factors:

Size (turnover and gross profit)

Size has a direct link to multiples: in general, the larger the business, the lower its risk. Revenue streams of large businesses are usually diversified, more so than smaller businesses. A business with a turnover of $200k would rarely have a multiple above 3. Businesses with turnover of $10mil would rarely have multiple below 3 (all other things being equal).

Key Person Reliance

The most significant factor for small businesses. If the owner left the business, would the business still exist? And if so, how would profits and performance be affected?

Industry (competition, barriers to entry)

While industry sector alone doesn’t determine the valuation multiple, it is one factor that can contribute to it. Consider that industries with a low barrier to entry can be easily replicated. From a potential buyer’s point of view, they have a choice to either buy an established business or simply start one from scratch. The latter option is often the cheaper option, an option which often reduces the value of existing businesses in that industry (supply & demand). Low barrier to entry businesses can include cafes & coffees shops or website developers.

Age of business

Older businesses have the ‘runs on the board’. Such businesses normally boast a diversified customer and supplier base and have been through the ‘ups and downs’ of business cycles. This being said, they have the challenge of remaining relevant.

Composition of customers and suppliers.

If a business relies heavily on one customer or one supplier, they have a huge risk of failure if they lose that one vital customer or supplier.

Outcome

The widely variable nature of businesses, even those within the same industry, precludes the adoption of a simplistic valuation multiple by industry approach.

To determine an appropriate valuation multiple for a business, one needs to firstly position the business in light of other investment opportunities such as fixed interest and listed shares. Then on a micro level, the individual business needs to be thoroughly reviewed to gain an understanding of the business’ risk profile. This can then be quantified by starting with a generally accepted risk free rate and then adding a risk premiums to build the required rate of return for the business. This required rate of return can then be converted to a business valuation multiple.

An independent business valuation compiled by a professional can help.

Contact BIZVAL to learn more and order your expert business valuation today.